The following blog post explores the current geopolitical climate through the lens of recent events in early 2026, examining the intersections of resource scarcity, economic volatility, and the “Donroe” (Don-Monroe) Doctrine.

The New Age of Annexation: Is the U.S. Running Out of Time—or Just Resources?

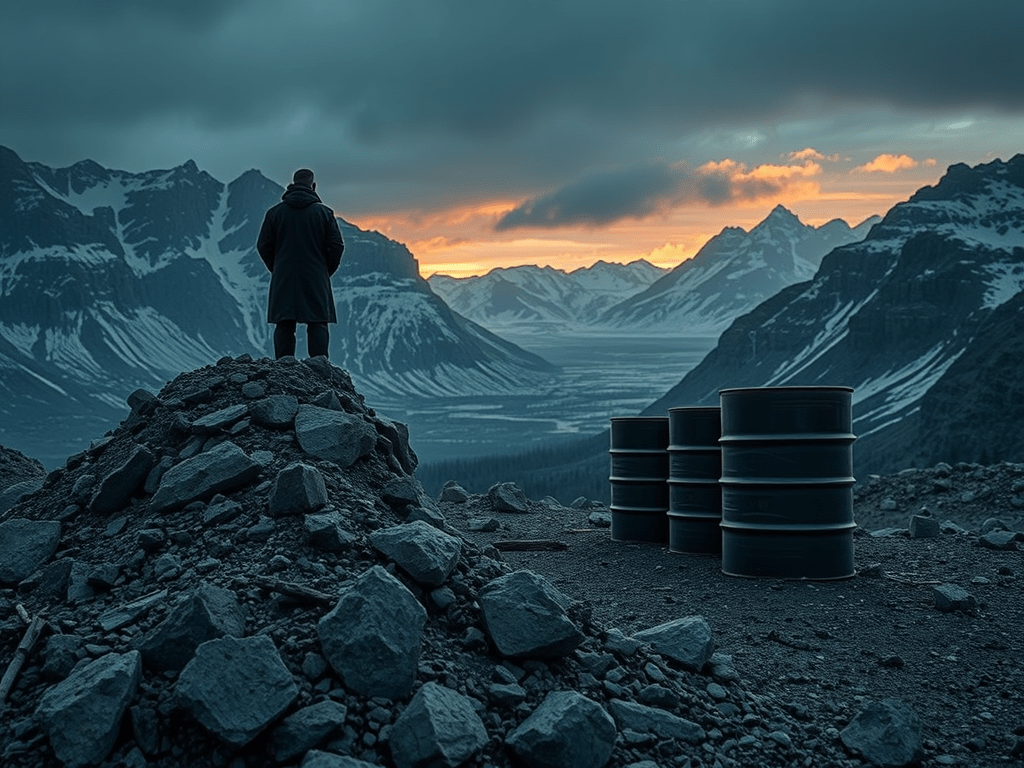

The start of 2026 has felt less like a new year and more like a throwback to 19th-century expansionism. With the recent capture of Nicolás Maduro in Venezuela, escalating demands for the annexation of Greenland, and increased friction with Canada, the world is asking: What is the endgame? While the official narrative often centers on “national security,” a deeper look at the economic indicators suggests a more desperate motive: a fight for the very resources required to keep the American engine running as the dollar faces a historic reckoning.

1. The Venezuelan “Regime Management”

In early January 2026, a U.S. special operation removed Nicolás Maduro from power. However, unlike previous “regime changes,” the system itself remains largely intact under Vice President Delcy Rodríguez.

Critics argue this isn’t about democracy—it’s about heavy crude. By establishing what some call a “protectorate,” the U.S. secures the world’s largest oil reserves and critical minerals. This move appears designed to bypass global supply shocks and reduce China’s influence in the Western Hemisphere, signaling that the administration is willing to use force to secure energy independence.

2. The Greenland Gambit and the Canadian Shield

The rhetoric regarding Greenland has shifted from “real estate interest” to “strategic necessity.” President Trump has recently intensified pressure on Denmark, citing the island’s rare earth minerals and its role in the “Golden Dome” missile defense shield.

The implications for Canada are particularly sharp:

- The 51st State Rhetoric: Recent references to Canada as a potential “51st state” have alarmed Ottawa.

- Arctic Sovereignty: The push for Greenland is viewed as a precursor to challenging Canadian claims in the Northwest Passage.

- Coercion at Davos: Canadian Prime Minister Mark Carney recently warned that “compliance will not buy safety,” urging middle powers to unite against U.S. economic coercion.

3. The Dollar and the Resource Reality

Is the U.S. dollar crumbling? In the first half of 2025, the greenback saw its biggest decline in over 50 years. While some analysts expect a mid-2026 recovery, the underlying fear is a structural collapse.

The theory is simple: The U.S. is running low on the domestic resources needed for the next generation of technology (like rare earths for EVs and AI) and is burdened by record-level debt. If the dollar loses its status as the world’s primary reserve currency, the U.S. loses its “exorbitant privilege” to print money to solve problems. In this light, the aggressive stance toward neighbors and resource-rich nations looks less like ego and more like a strategic grab to back the dollar with tangible, physical assets.

4. Domestic Friction: The ICE Tipping Point

Internally, this “force-first” philosophy is mirrored in the expansion of ICE (Immigration and Customs Enforcement). With deaths in custody reaching record highs and the deployment of heavily armed agents into cities like Minneapolis, public sentiment is shifting. Recent polling suggests a majority of Americans feel these enforcement efforts have “gone too far,” creating a domestic rift that matches the international tension.

Conclusion: A World Splintered

The belief that the U.S. can take what it wants by force assumes that the global order will remain passive. But as trade wars loom with the EU and the UK over Greenland, and as Canada asserts its sovereignty more aggressively, the “Donroe Doctrine” may lead to a splintered world rather than an American-led one.

If the dollar plummets and resources remain the primary target, the “hard way” may eventually become the only way the current administration knows how to negotiate.

Leave a comment